Buoyed by a mix of market correction and federal government assistance like PPP loans, payroll tax cuts, etc., FRANdex achieved major quarter-over-quarter gains in Q2-2020. In the quarter, franchise companies’ (excluding McDonald’s) annual returns outperformed both broader indices – S&P 500 and Russell 2000. Non-food franchises were the major gainers in the quarter, up 51.6% […]

Buoyed by growing consumer spending and growth in disposable income levels, FRANdex achieved major year-over-year gains in 2019. In the year, franchise companies’ (excluding McDonald’s) annual returns were almost like those achieved by the S&P 500 and the Russell 2000 indices. Hospitality franchises were the major gainers in the year, up 34.5% y-o-y; overall the […]

Improved market for dining out help food franchises outdo their non-food counterparts in Q3. In Q3-2019, franchise companies’ (including McDonald’s) returns were in line with S&P 500 but underperformed the Russell 2000 index. Food franchises outperformed their non-food counterparts. Returns for FRANdex+M declined by 5.46% Q-o-Q, with those for food companies up down 3.13% Q-o-Q. […]

For the second quarter in a row franchises posted strong positive returns. In Q2-2019, franchise companies’ returns significantly outpaced those for both Russell 2000 and S&P 500. Non-food franchises outperformed their food counterparts, with latter losing further market capital as “go-private” deals for brands like Papa Murphy’s continued to impact the FRANdex in Q3. Returns […]

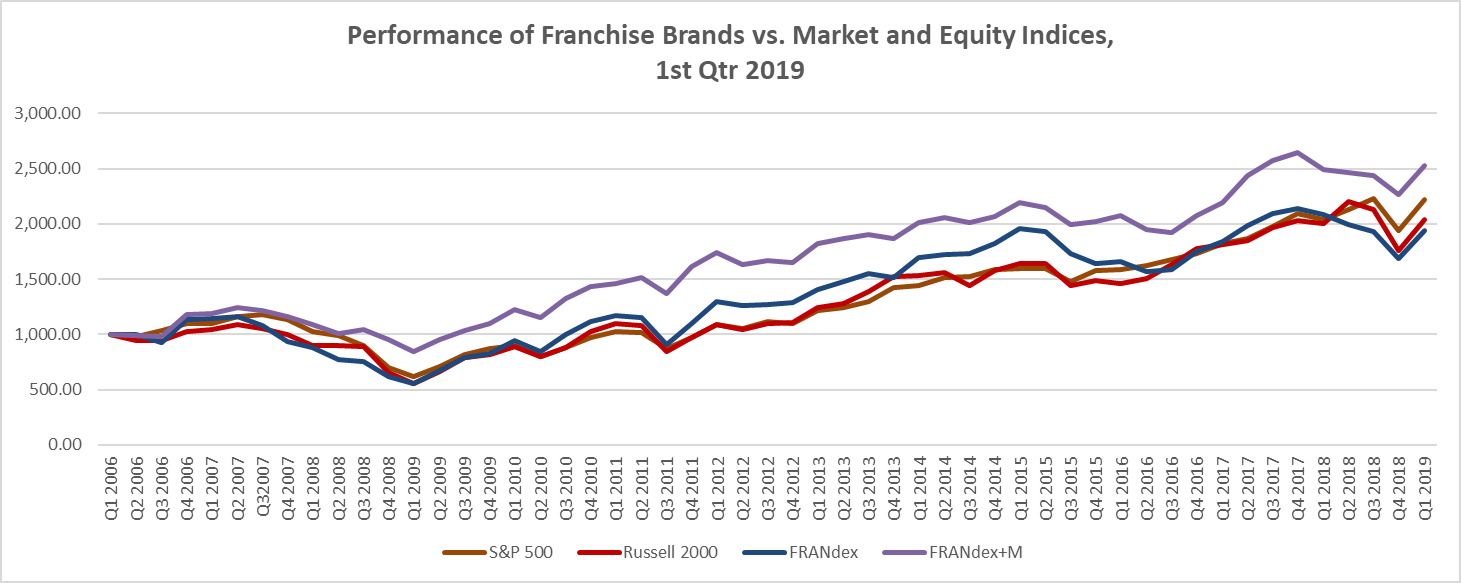

The year is off to a great start, with franchises posting positive returns in the first quarter. In Q1-2019, franchise companies’ returns slightly outpaced those for Russell 2000, and were almost in line with those for the S&P 500. Non-food franchises significantly outperformed their food counterparts, with latter having lost a lot of market capital […]