by: Claire Liuzza, Research Analyst

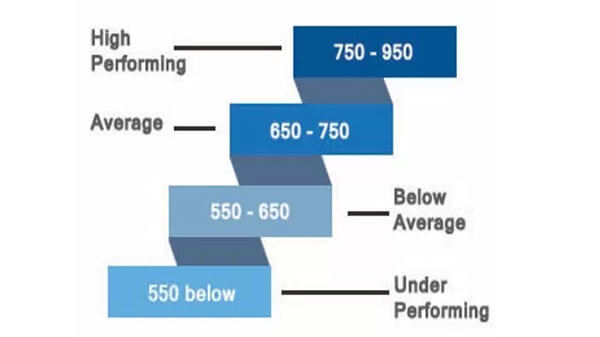

Some 35% of franchised brands that FRANdata has analyzed are under-performers based on their FUND score. What does this mean to you? What this means to you, the lender, is that a franchisee/borrower has a better chance of succeeding with a brand that has a high FUND score. So in turn, when working with a brand having a low FUND score, this would require you to have more confidence in the borrower and make closer consideration of loan terms.

Just like a FICO score, multiple factors are considered when deriving a franchise brand’s FUND score. Broadly, this score takes into account two historical categories and one projection category. Within these categories, we assess the potential for a brand’s near-term success based largely on the performance of the franchise system, and franchisor, including but not limited to the number of franchised units that remain open for business, the relationship and support structures between the franchisor and franchisees, the brand’s executive team, and the franchise agreement. Although many brands generate high scores in these categories, some successful franchise systems generate unexpectedly low FUND scores.

Lack of Transparency

Lack of Transparency, particularly in areas like system revenue changes, unit economics, and the franchisee/franchisor relationships are often are big culprits of low FUND scores, and understandably so. If insufficient information is available for lenders to understand a franchise system’s performance, they lose a key advantage over independent company analysis, due to the inability to accurately differentiate franchisee performance associated with different brands.

New Management or Multi-Brand Focus

A franchise system’s culture is an important influencer of outcomes, and the franchisor management team owns this culture. New franchisees might need time to understand the brand, acclimate to system culture, or handle obstacles related to their transitions. Adjustment issues could result in sub-par performance or poor decision-making if the belief of both franchisor and system support is not present. Multi-brand focus can also be a great concern. When executives serve multiple brands, they must divert time and attention from one in order to serve another.

Franchisee Support

Although the crucial support services can differ by industry, and business model issues arising from the new joint employer legislation are impacting support levels, franchisee support is arguably one of the most important factors in a brand’s success and continuity. Think of the franchisor as a mentor- the more advice and assistance franchisees receive throughout the term of the agreement, the more likely they will perform well. Franchisors offering minimal support risk leaving their franchisees to fend for themselves in unfamiliar scenarios, where one poor decision could result in a business failure and loan default.

Franchise Agreement Risks

Franchise agreements can put franchisees in positions where they are unable to repay their loans due to excessive fees or responsibilities in the event of a breach or transfer, as well as during the term of the agreement if the franchisor reserves certain rights to obtain increasing portions of unit revenue through ongoing fees (royalties, marketing contributions, technology maintenance and upgrades, etc.). Any occurrence that would affect the franchisees’ ability to make loan payments is a red flag for lenders.