Lending Institutions

Unlike other small businesses, franchise businesses have a wealth of information that can help you understand your risk. Not only does the performance of other units give you an indication of the business you are considering funding, but the system overall also offers support and advantages to a franchisee that are not available to independent businesses.

From the business development perspective, these unique characteristics of a franchise system also make them excellent prospects:

- Because each business location is a template of the other, their needs are predictable

and replicable, so one loan product will be applicable to many

and replicable, so one loan product will be applicable to many - Because the system acts like a network, if you become a preferred or recommended lender by the franchisor, you will automatically reach each individual franchised business.

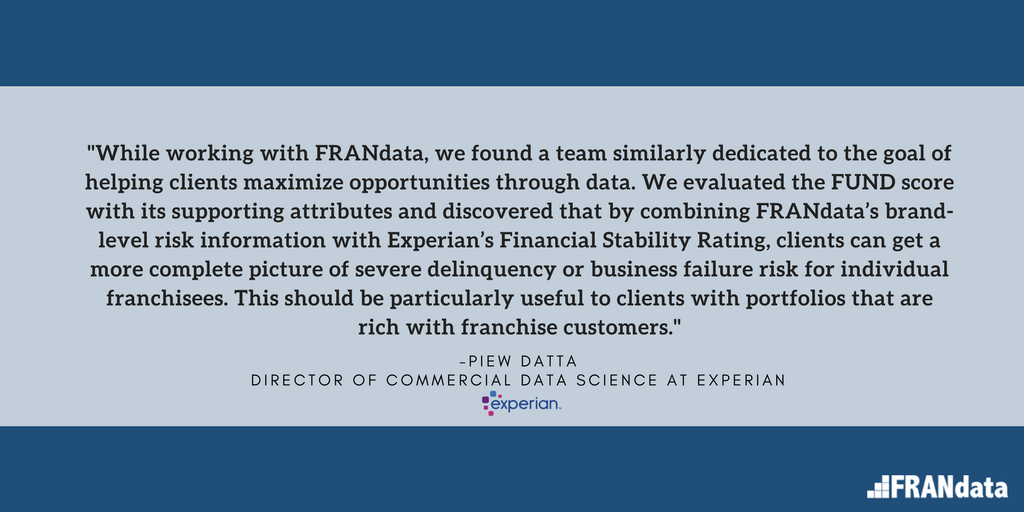

With decades of experience in lending and franchising, FRANdata is uniquely able to provide our clients with the information they need to both understand risk and maximize their franchise portfolio. We are constantly defining new best practices in franchise lending– from creating specific tools like the FUND (Franchise Credit Scoring) report and BCR (Brand Credit Report) that help make informed lending decisions to creating objective, in-depth, and customized analyses of the performance of a franchise.

For almost 20 years, FRANdata has operated the Franchise Registry (www.franchiseregistry.com), which is dedicated to facilitating franchise financing. Used by more than 9000 small business lenders nationwide, the site provides a wealth of information about every franchise operating in the U.S.

If you are a small business lender and do not have a complimentary login, send your contact information to franchiseregistry@www.frandata.com, and we will get you started today.