Buoyed by a mix of market correction and federal government assistance like PPP loans, payroll tax cuts, etc., FRANdex achieved major quarter-over-quarter gains in Q2-2020. In the quarter, franchise companies’ (excluding McDonald’s) annual returns outperformed both broader indices – S&P 500 and Russell 2000. Non-food franchises were the major gainers in the quarter, up 51.6% […]

While returns for FRANdex were down by -12.95% Q-o-Q, the recent volatility in the markets led to FRANdex outperforming broader indices in Q4 2018. The returns for S&P 500 and Russell 2000 in Q4 were -13.15% and -17.40%, respectively. Hotel companies performed better than food franchises which saw their returns decline by 10.26%. Overall, […]

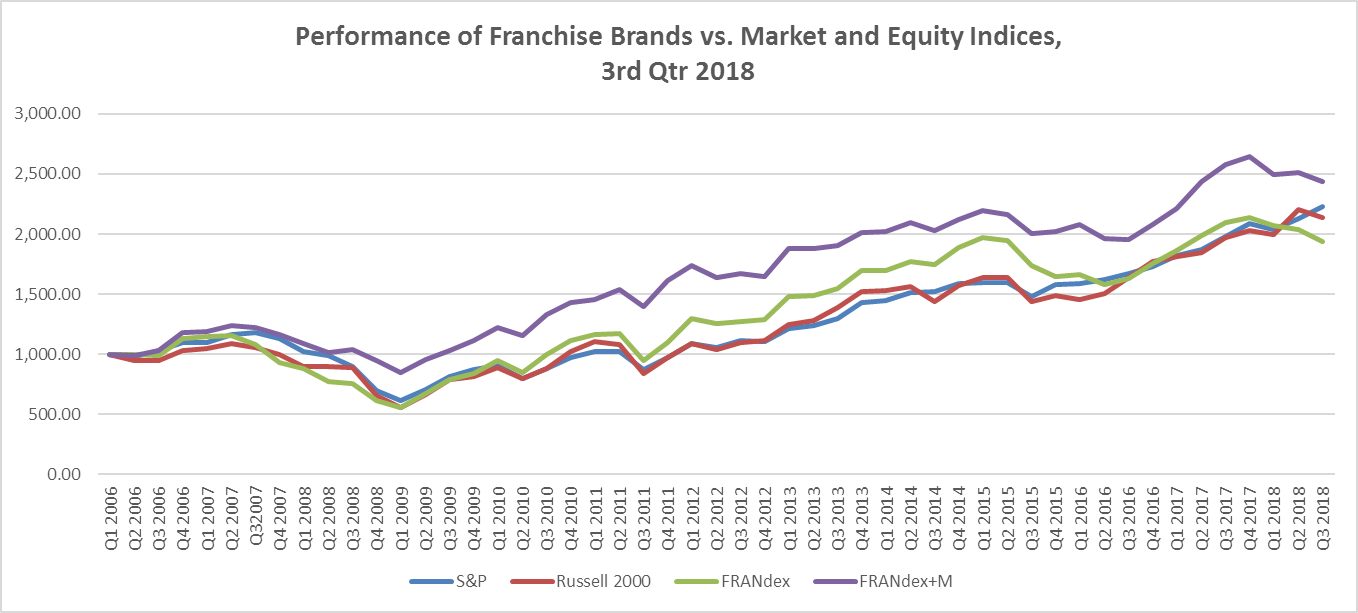

Just as the FRANdex had started showing signs of recovery in the previous quarter, the rise in take-private PE acquisitions created dents to the index performance in Q3-2018. FRANdex underperformed both the broad indices. While the S&P 500 rose by 4.8%, Russell 500 declined by 3.2%; in the same period FRANdex declined by 5.1% q-o-q. […]

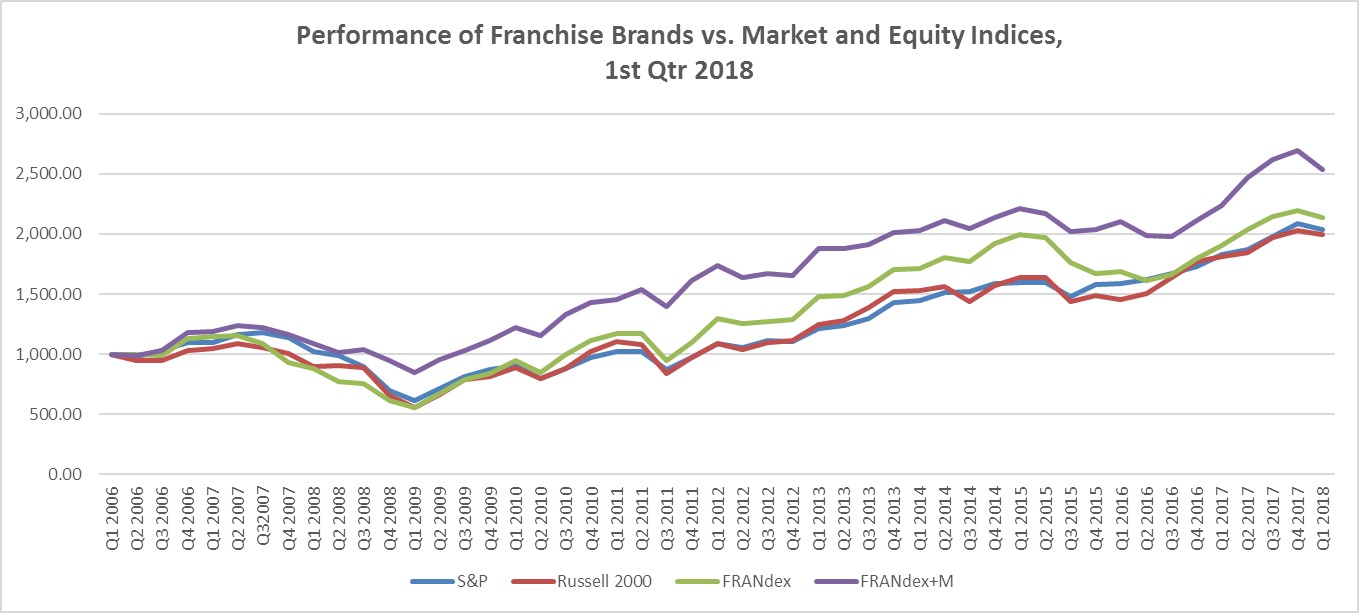

After a rough stretch of market volatility, the FRANdex just snapped its quarterly win streak that stretches back to 2016. FRANdex registered lower Q-o-Q returns (-2.99%) as compared to both the broader indices. S&P 500’s returns were down -1.64%, while Russell 2000’s by -2.43%. Click here to download the latest FRANdex.

FRANdata developed and uses the FRANdex to see how franchising is performing against other indexes like the Dow Jones. With the recent crash of the Dow, we take a look at the impact it’s had on franchising. The falling stock market crash had a significant impact on companies in the FRANdex: Its periodic decline […]