By Sveta Lasco, Junior Research Analyst We can learn a lot about how resilient a franchise system is by looking at its performance across a full economic cycle. By now we are all familiar with the path leading to the last recession where loose credit standards led to an overly aggressive housing lending market. That fast-paced […]

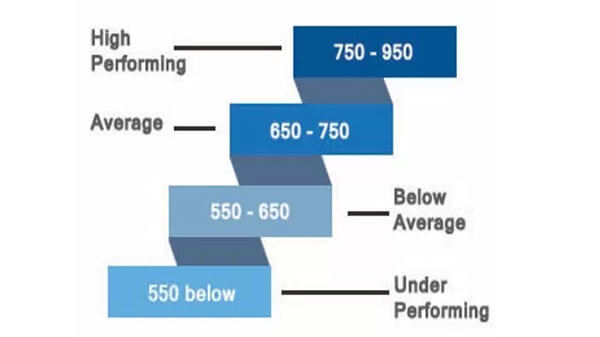

by: Claire Liuzza, Research Analyst Some 35% of franchised brands that FRANdata has analyzed are under-performers based on their FUND score. What does this mean to you? What this means to you, the lender, is that a franchisee/borrower has a better chance of succeeding with a brand that has a high FUND score. So in turn, when working […]

The Most Credit-Worthy Brands in Franchising What makes a franchised business credit-worthy? The FUND report measure a franchise brands’ credit risk by analyzing key performance indicators from a credit risk perspective. Based solely on public information, it bridges the gap in a lender’s due diligence: where once they could closely assess only a borrower, now […]

Understanding FUND – The Credit Score of Franchising A good credit score is what every borrower aspires to and what every lender wants to base their portfolio on. A credit score is one of the most important determining factors not only for when it comes to granting a loan – but also in determining the […]