One of the most asked question from lenders on the FUND Score/Report, has got to be “Its great when my borrower is investing in a brand with a high franchise credit (FUND) score, and there are many, but what does it mean to the loan or my lending process when the franchise is scored low?” […]

Possessing franchise information going back decades, FRANdata was in a unique position to assist the lending community to build an accurate credit risk assessment system for franchise brands. With lots of input from experienced franchise lending institutions, FRANdata developed a model that measures credit risk in franchise brands. Applying this model to more than 500 […]

Salt Lake City, UT, November 14, 2016 – Celtic Bank is integrating FRANdata’s proven franchise scoring system (FUND Score) into their franchise portfolio management system. This integration ensures that both franchisees and franchisors who do business with Celtic Bank will benefit from franchise loans that are administered faster, are more transparent, and most importantly, adapted […]

The Most Credit-Worthy Brands in Franchising What makes a franchised business credit-worthy? The FUND report measure a franchise brands’ credit risk by analyzing key performance indicators from a credit risk perspective. Based solely on public information, it bridges the gap in a lender’s due diligence: where once they could closely assess only a borrower, now […]

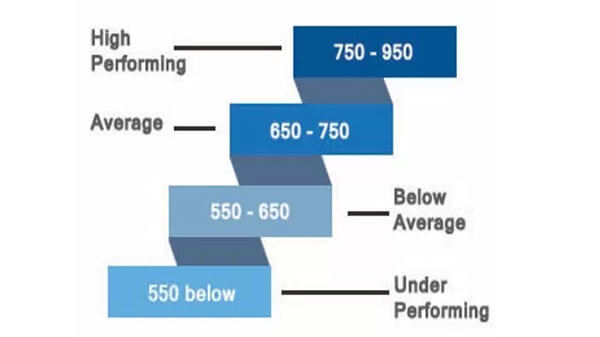

Understanding FUND – The Credit Score of Franchising A good credit score is what every borrower aspires to and what every lender wants to base their portfolio on. A credit score is one of the most important determining factors not only for when it comes to granting a loan – but also in determining the […]