One of the most asked question from lenders on the FUND Score/Report, has got to be “Its great when my borrower is investing in a brand with a high franchise credit (FUND) score, and there are many, but what does it mean to the loan or my lending process when the franchise is scored low?” […]

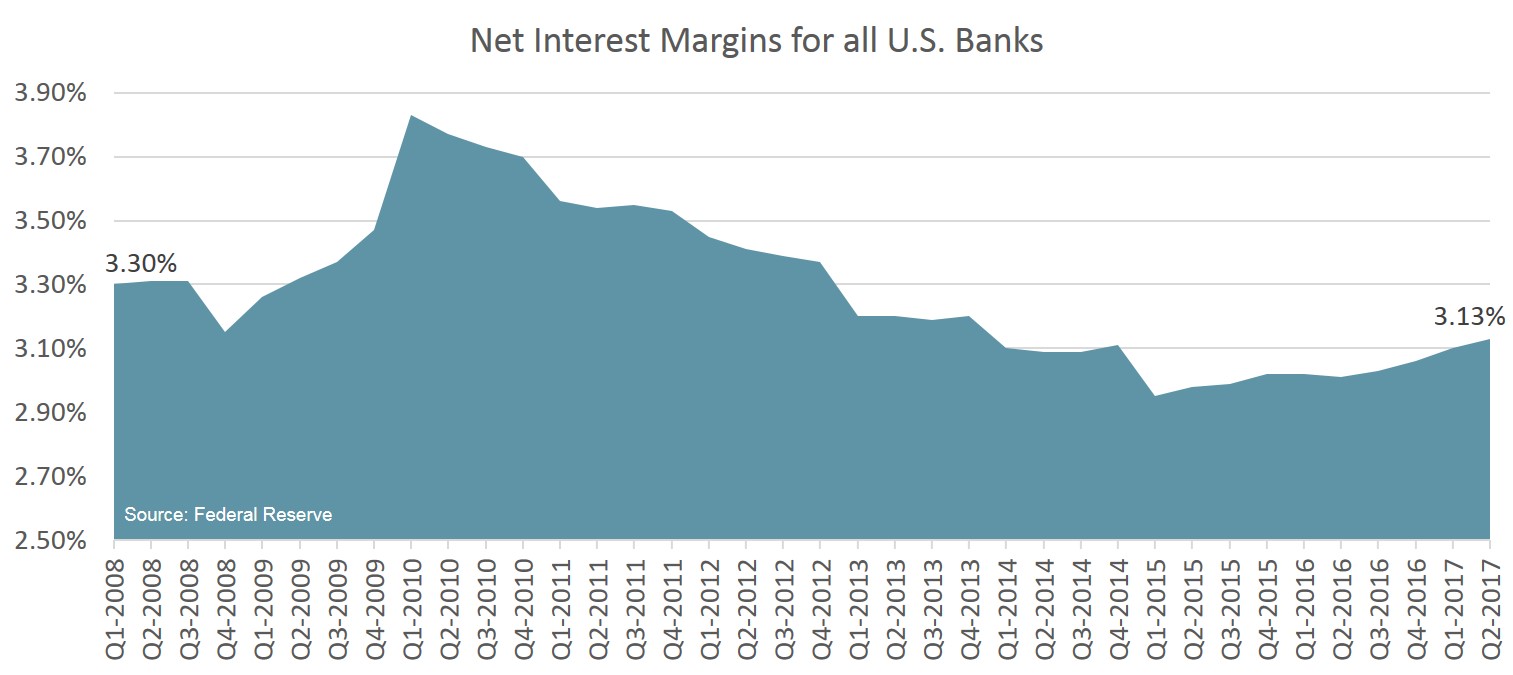

Lenders Counter with Technology Solutions The historically flat yield curve and rising internal costs are reducing small business lending profitability, pushing lenders into a classic capital for labor shift – relying more on technology to evaluate brands and borrowers. In a poll of more than 150 Lenders– 89% found that evaluating the franchise brand’s credit profile […]

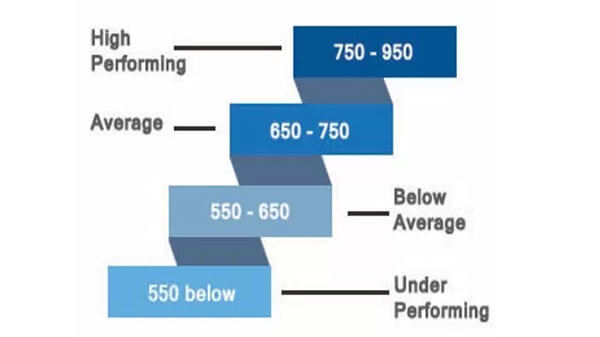

Possessing franchise information going back decades, FRANdata was in a unique position to assist the lending community to build an accurate credit risk assessment system for franchise brands. With lots of input from experienced franchise lending institutions, FRANdata developed a model that measures credit risk in franchise brands. Applying this model to more than 500 […]

Salt Lake City, UT, November 14, 2016 – Celtic Bank is integrating FRANdata’s proven franchise scoring system (FUND Score) into their franchise portfolio management system. This integration ensures that both franchisees and franchisors who do business with Celtic Bank will benefit from franchise loans that are administered faster, are more transparent, and most importantly, adapted […]

New Providence, New Jersey — In support of the Small Business Administration’s (SBA) Veteran’s week, ReadyCap Lending, a leading non-bank small business lender, is proud to announce an exclusive military veteran franchise SBA lending program. Called the Military Veteran Franchise Business Ownership (MVP) Lending Program, this platform reaffirms ReadyCap’s commitment to supporting the SBA’s mission […]